utah state solar tax credit 2019

Utahs solar tax credit currently is frozen at 1600 but it wont be for long. State Low-income Housing Tax Credit Allocation Certification.

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

June 5 2019 512 PM.

. If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar costs. File with your state taxes. You might have heard of the Utah State initiative as the Renewable Energy System Tax Credit RESTC program.

According to the Utah State Tax Commission httpincometaxutahgovcreditsrenewable-energy-systems You can get Form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification stamp. This bill provides stability for the Utah solar market as it adapts to changes to rate structures and net metering. Attach TC-40A to your Utah return.

To use the 25 of the eligible system cost or 1600 credit until 2021 you will need an account with the Governors Office of Energy Development along with your TC-40E. You can claim 25 percent. The Production Tax Credit is available for large scale solar PV wind biomass and geothermal electricity generating renewable energy projects over 660 kilowatts nameplate capacity system size.

04 Capital Gain Transactions Credit. The individual income tax credit for residential systems is 25 of the reasonable installed system costs up to a maximum credit of 2000 per residential unit. The Utah tax credit for solar panels is 20 of the initial purchase price.

Both tax credits are expected to phase out. The PTC is calculated as 0035 35 per kilowatt hour of electricity produced during the projects first 48 months of operation after the Commercial Operation Date. Fill out the rest of the form as you normally would when filing your state taxes.

The Utah tax credit for solar panels must be used within 3 years of the purchase date of the solar panels. Ad Find Out How Much You Would Save With Solar Panels After Federal And State Incentives. As of March 2019 the Utah solar tax credit is 060 per watt based on the alternating rate schedule.

20 Utah my529 Credit formerly UESP. This was confirmed by Governor Gary Herberts office. Utah Governor Gary Herbert signed a new bill into law SB 141 that grants an extension to the states solar tax credit.

You can claim 25 percent of your total equipment and installation costs up to 800. Write the code and amount of each apportionable nonrefundable credit in Part 3. This means that if you had a 5-kilowatt solar system installed on your house you would.

Ad This is the newest place to search delivering top results from across the web. The bill extends the cap on the maximum credit each residential solar system can claim under the 25 solar tax credit by two years. Utah state solar tax credit 2019 Thursday August 4 2022 Edit.

18 Retirement Credit. Add the amounts and carry the total to TC-40 line 24. Refund of Tax Reported on Exempt Fuel for Utah Based Carriers.

This form is provided by the Utah Housing Corporation if you qualify. Starting in 2021 it will resume its yearly phase down until this tax credit reaches zero at the end of 2023. 1600 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit.

In Utah the solar investment tax credit ITC is calculated as 25 percent of the eligible system with a 2000 maximum. Thats in addition to the 26 percent federal tax credit for solar not a bad deal for a system that can save you thousands each year on. Utah solar customers would be wise to invest in solar before the available funding is no longer within their reach.

22 Utah income tax - subtract line 20 from line 10 not less than zero 22 USTC ORIGINAL FORM Utah State Tax Commission Utah Individual Income Tax Return All State Income Tax Dollars Fund Education 2019 40901 TC-40 If deceased complete page 3 Part 1 Electronic filing is quick easy and free and will speed up your refund. Calculate What System Size You Need And How Quickly It Will Pay For Itself After Rebates. Content updated daily for utah solar tax credit.

You can receive a maximum of 1000 credit for your purchase. Codes for Apportionable Nonrefundable Credits TC-40A Part 3. There is no tax credit on solar panels that you purchase and then sell to someone else.

Utah Based Carrier Exempt Fuel Detail. How are tax credits changing. How does the Utah tax credit for solar panels work.

Taxpayers wishing to use this tax credit must first apply through the Utah State Energy Program before claiming the tax credit against their Utah state taxes.

Yellowstone National Park Hiking Trails Trail Hiking Series Yellowstone National Park Hiking National Parks Yellowstone

Aerospace Enthusiast Uses Cnc Machine To Replicate New Mac Pro Grille Design Cheese Grating Ensues

First Solar Inks 2 4gw Solar Module Deal With Intersect Renews Renewable Energy News

Solar Power Potential Ranked By Land Cover Classification The Download Scientific Diagram

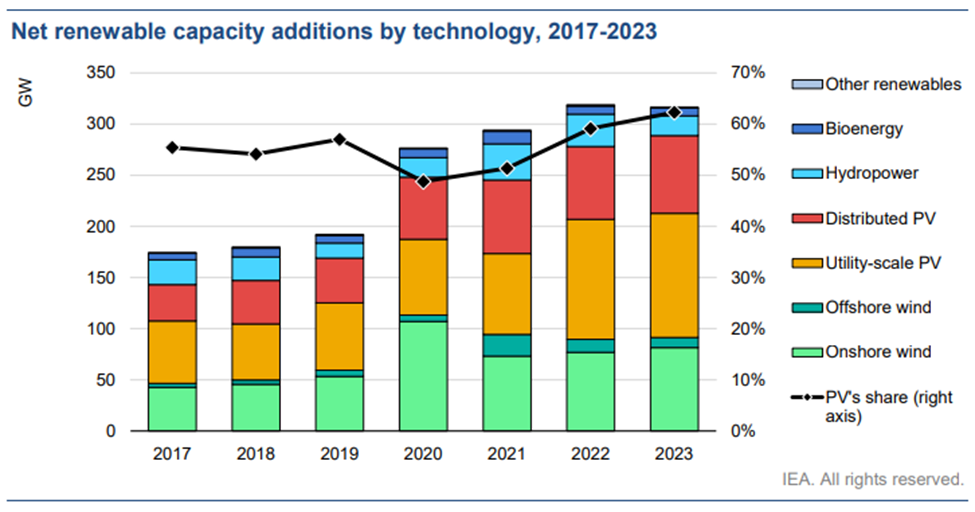

Solar Expected To Add 190gw Of Capacity This Year Before New Energy Policies Taken Into Account Iea Pv Tech

Garbo Kane Integrated Solar Builders Home Facebook

Solar Power Potential Ranked By Land Cover Classification The Download Scientific Diagram

10 Nevada 1976 Nevada Nevada Usa Vacation Places

The Energy Transition In Chile Thanks To Enel Enel Green Power

Hastings Acadamy Uses Onelan For Immersive Solution Digital Signage Signage Video Projection

Solar Power Potential Ranked By Land Cover Classification The Download Scientific Diagram

Why You Should Steer Clear Of Florida Man Challenge

Up To 90 Off On Solar Panel Installation At Find My Solar In 2022 House Design Modern House Solar House

Who Do I Think I Am Anyway Dark Backgrounds Dental Plans Free Stock Photos

Off Grid Solar Attracted Record Us 450m Investment Last Year Pv Tech

Where And When To See The May 20 Solar Eclipse Eclipse Photos Solar Eclipse Solar Eclipses